Gold, Bonds, & Stocks Rip After 'Bad' Data On 'Quietest Day Of The Year'

An ugly jobless claims print was the day's early catalyst sending yields significantly lower, stocks, gold, oil, and crypto higher and the dollar down with rate-cut expectations re-ignited...

Source: Bloomberg

A dovish shift supported stocks - which had a "squeezey feel" amid very low liquidity...

Source: Bloomberg

Goldman's trading desk noted that while yesterday was the lightest notional session all year in the US, today is looking to be even slower (tracking down -2% vs. yesterday), which probably helped the liftathon...

The Dow and Small Caps led the way - up almost 1%, and Nasdaq lagged on the day - barely holding on to green...

This was The Dow's seventh straight daily gain - the longest win streak since July 2023.

And both Hedge Funds and Long-Onlys were sellers today (which leaves buybacks - as we predicted - to save the market)...

HFs are -7% for sale and lean better for sale in every sector ex- Cons Disc & Macro Products. Supply is most pronounced in Info Tech & Utes which when combined, make up 2/3 of overall HF net supply.

LOs are -11% for sale with notable supply in Fins & REITs while HCare, Mats, Indust & Info Tech are also net for sale. Demand is modest across Cons Disc, Utes & Macro Products

MAG7 stocks spent a third day going nowhere...

Source: Bloomberg

0-DTE Call-buyers dominated the action today...

Treasuries were bid across the curve today with very early steepening erased by the close thanks to a strong 30Y auction)...

Source: Bloomberg

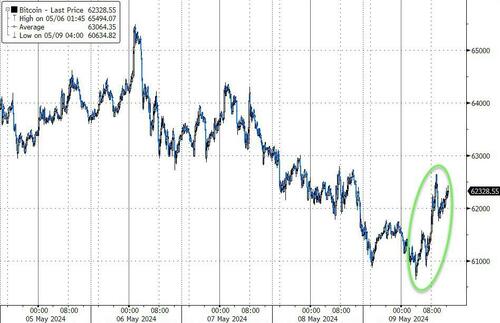

A small net inflow into ETFs yesterday supported bitcoin and as the dollar sank, crypto was bid today too...

Source: Bloomberg

Gold surged back above $2340...

Source: Bloomberg

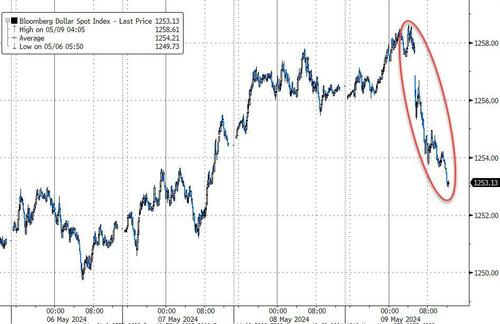

As the dollar dived...

Source: Bloomberg

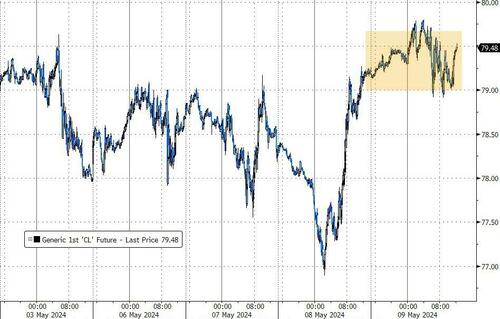

Oil prices ended marginally higher, after chopping around much of the day...

Source: Bloomberg

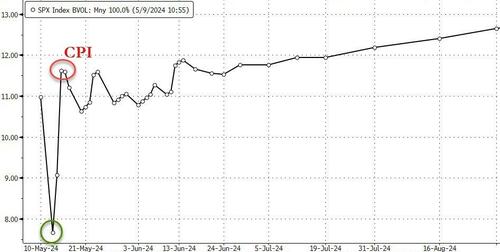

Finally, while fear is gone through Monday, it returns for CPI and vol is pricing in some anxiety next week...

Source: Bloomberg

That '7'-handle vol for Monday looks very cheap.